How to Buy Crypto with OCBC Bank

Summary: While OCBC Bank doesn’t offer crypto trading on its own platform, you can easily use your account to buy crypto using a third-party crypto exchange.

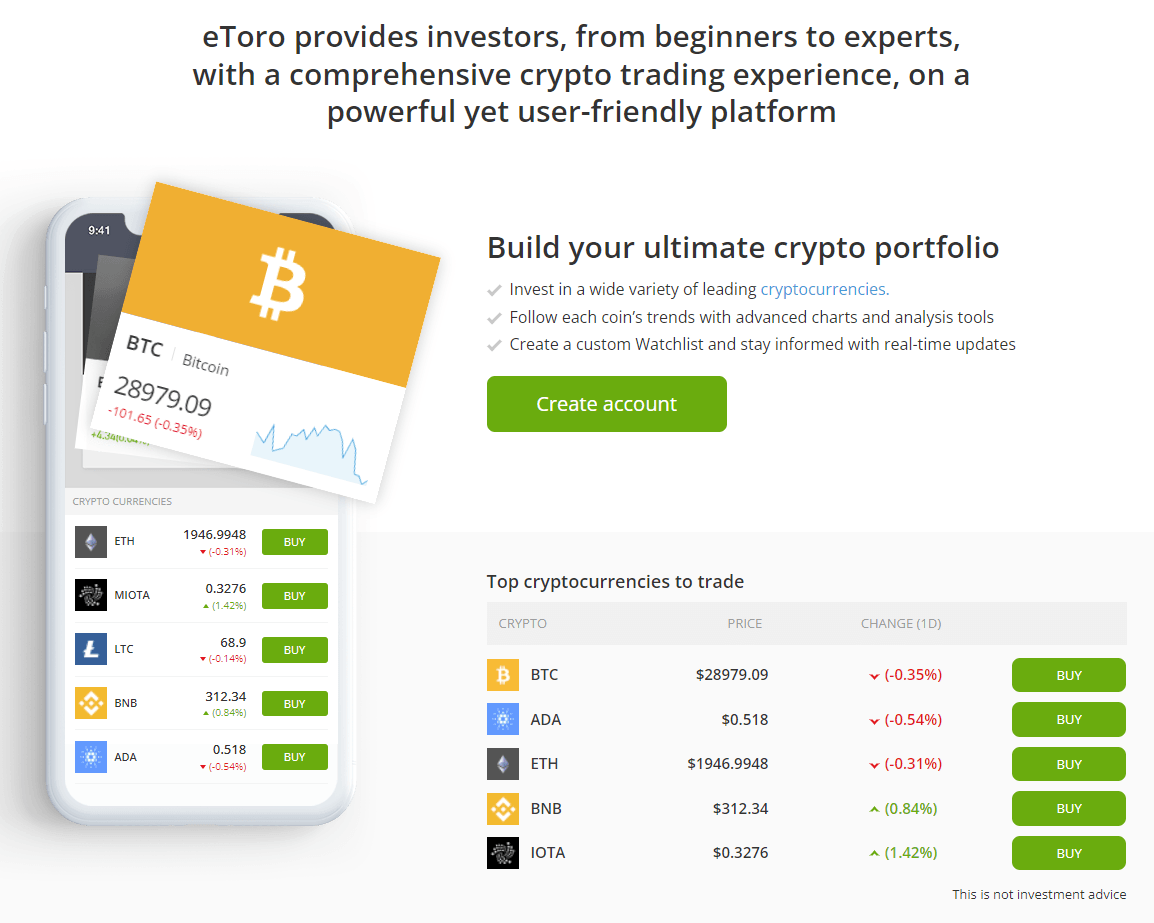

There are plenty of crypto exchanges to choose from, we recommend using eToro as the exchange to work with.

They have most of the popular cryptocurrencies available, are easy to work with, and have fantastic support!

Buy Crypto with eToro

[Rated 4.2/5 based on 15710 reviews on Trustpilot]

As mentioned above, just like most banks, OCBC Bank doesn’t offer cryptocurrency trading directly, as setting up a cryptocurrency exchange is quite complex and comes with regulations and extra requirements for the banks.

Luckily for us, there are plenty of cryptocurrency exchanges to choose from that you can use to buy bitcoin or any other cryptocurrency you might want.

Once signed up to an exchange (we’ll be using eToro for our example as it’s a widely trusted and global exchange), you can simply transfer funds from your bank account to the exchange, and trade it for crypto.

Table of Contents

How to buy crypto or bitcoin with OCBC Bank

There are only 4 steps involved, let’s get started!

1. Choose a cryptocurrency trading platform

As mentioned above, we’ll be using eToro for this guide as they are a widely used exchange and have over 50 cryptocurrencies to choose from. They also have a few really neat features like “Copy Trading”, which enables users to copy the trades of popular investors on the platform.

You can, of course, use any trusted crypto exchange for this, the steps will be very similar for most exchanges.

Let’s get started!

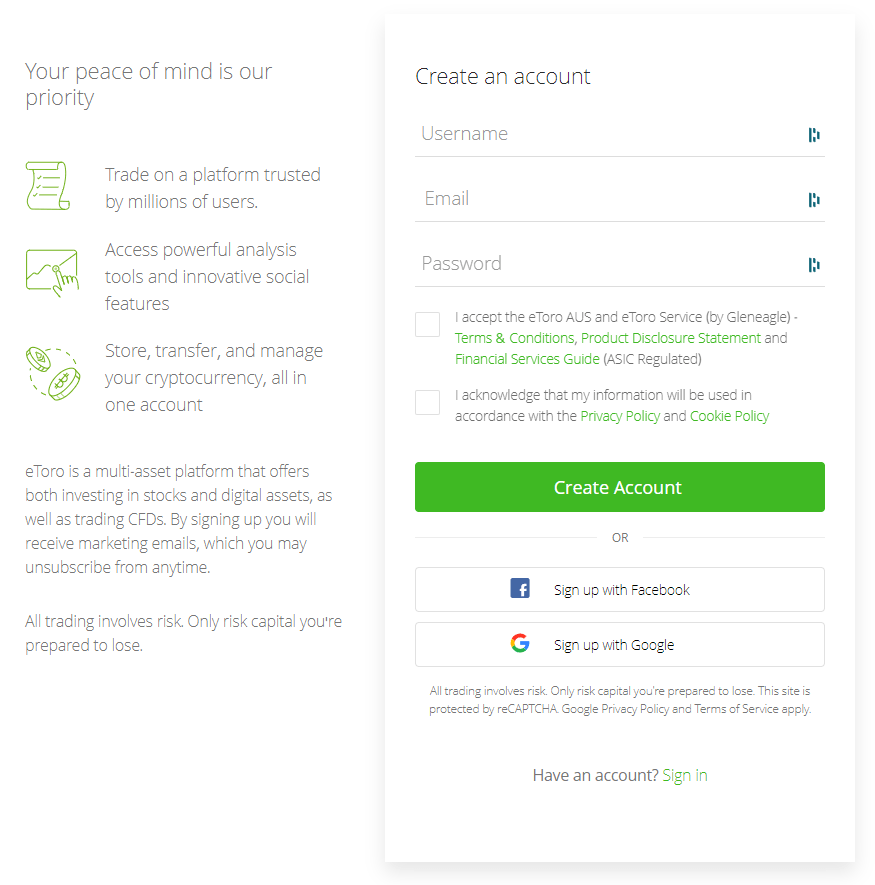

2. Sign up with the trading platform

The first thing to do is to sign up with the platform.

Once you’ve completed the initial sign up process, you’ll have to go through a quick verification process (also known as KYC).

3. Funding your account

Next up is funding your account. When it comes to depositing money to your eToro account, you have the option to use a bank transfer, PayPal, credit/debit card, and more.

4. Buy crypto

Finally, just go to the eToro Markets section, find the cryptocurrency you would like, and buy it.

And that’s it, it’s all pretty straightforward, now you know how to buy bitcoin or most other cryptocurrencies with OCBC Bank.

About OCBC Bank

Oversea Chinese Banking Corporation, Limited, also known as OCBC Bank, a multinational bank and financial services company based in Singapore's OCBC Centre. OCBC Bank was created in the Great Depression by the consolidation of three banks in 1932: the Chinese Commercial Bank Limited (incorporated on 1912), the Ho Hong Bank Limited (1917) and the Overseas-Chinese Bank Limited (1919).

OCBC Bank's assets exceed S$521.3 million, making it the second-largest bank in Southeast Asia in terms of assets and one of the largest banks in Asia-Pacific. It has an Aa1 rating by Moody's and an AA- rating at Standard & Poor's.

Global Finance Magazine consistently ranks OCBC Bank among the top five most secure banks in the world. OCBC Bank Singapore was named by Asian Banker as the strongest bank in 2018-2019 and 5th in Asia-Pacific. The bank's global network now includes more than 570 branches in 18 countries and regions. There are more than 320 branches in Indonesia and over 100 in China, Hong Kong and Macao, which are all part of the OCBC Wing Hang Bank. Global Finance Magazine named OCBC Bank the World's Best Bank (Asia-Pacific), in 2019.

Three banks, Chinese Commercial Bank (1912), Ho Hong Bank (1997) and Oversea Chinese Bank (1919) merged to create Oversea Chinese Banking Corporation, which was led by Lee Kong Chian and Hoklos Tan Ean Kilam. The bank grew its operations over the years and was the largest bank in South East Asia.

All local banks in Singapore were closed during World War II. OCBC was among the few banks that had resumed normal operations by April 1942. OCBC branches in Sumatra were closed by the Japanese occupation authorities. The bank relocated its headquarters to Bombay in India during the war and was only re-registered in Singapore after it ended. OCBC's branch at Xiamen was spared the war. In the 1950s OCBC was among four foreign banks that had branches in China.

OCBC established branches in Surabaya, Jakarta and Jambi after the war. OCBC's branches in Indonesia and Malaysia, which then included Singapore, were closed due to the 1963 conflict. The revolutionary government of Burma also nationalized OCBC's two branches in Burma that year, transforming them into People's Bank No. 14.

It was criticised for not growing fast enough to meet post-war Chinese business needs, particularly in smaller Malayan towns. Tan Sri Khoo Teck Puat was one of those critics. He later resigned to establish Malayan Banking. OCBC had more assets than 1 billion Singapore dollars by 1970. OCBC was the largest financial institution in Singapore with the greatest deposit base.

OCBC bought Four Seas Communications Bank in 1972. It was the oldest Chinese bank still standing in Singapore. It was founded as the Sze Hai Tong Bank in 1906. The founders of the bank targeted the Teochew community.

OCBC Bank changed its logo and name to OCBC Bank on May 9, 1989.

It had branches in Hong Kong, Bangkok and Shanghai. In fact, it was the first Chinese bank to open a branch there in 1909.

OCBC Bank purchased Keppel Capital Holdings, Keppel Securities and Keppel TatLee Finance in 2001. OCBC legally and operationally integrated Keppel TatLee Bank the following year. OCBC Bank merged OCBC Finance with OCBC Bank in 2003.

2004 was the year of the official opening at e2 Power's Cyberjaya Office. 2004 saw the official opening of OCBC Bank’s Kuala Lumpur corporate headquarters. In addition, OAM announced the merger of its asset management operations with Straits Lion Asset Management. OCBC opened a branch off-shore in Brunei.

OCBC announced in March 2020 its partnership with Xero (a cloud accounting software based in New Zealand) to digitize clients' operations.

OCBC launched HealthPass in July 2020. This mobile app for healthcare connects patients to doctors in Singapore via an online consultation.

Related:

Author: Marco Vela -

Author: Marco Vela -