How to Buy Crypto with St. George Bank

Summary: While St. George Bank doesn’t offer crypto trading on its own platform, you can easily use your account to buy crypto using a third-party crypto trading platform.

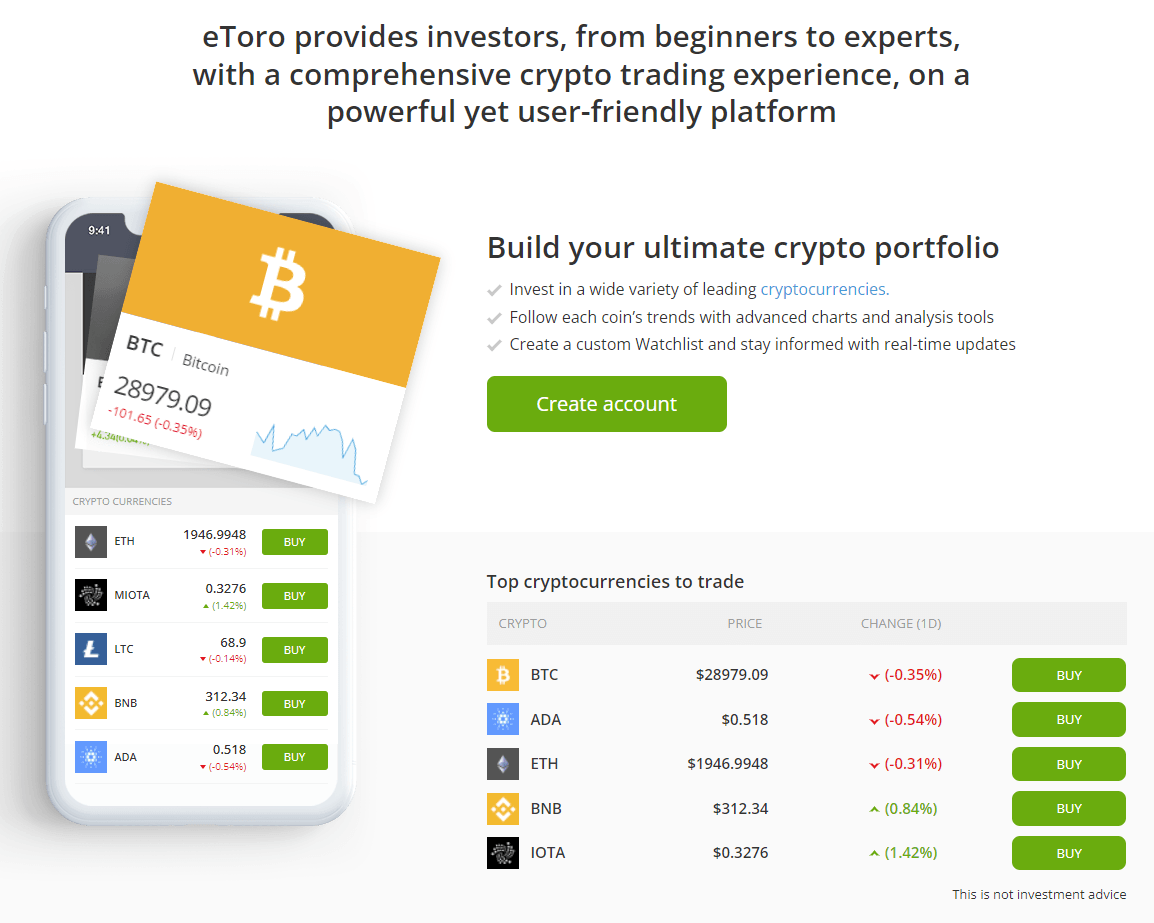

There are plenty of Australian crypto exchanges to choose from, we recommend using eToro as the exchange to work with.

They have most of the popular cryptocurrencies available, are easy to work with, and have fantastic support!

Buy Crypto with eToro

[Rated 4.2/5 based on 15710 reviews on Trustpilot]

As mentioned above, just like most Australian banks, St. George Bank doesn’t offer cryptocurrency trading directly, as setting up a cryptocurrency exchange is quite complex and comes with regulations and extra requirements for the banks.

There are many crypto trading platforms that you can use for buying bitcoin and other cryptocurrencies.

Once signed up to an exchange (we’ll be using eToro for our example as it’s a widely trusted and global exchange), you can simply transfer funds from your bank account to the exchange, and trade it for crypto.

Table of Contents

How to buy crypto or bitcoin with St. George Bank

There are only 4 steps involved, let’s get started!

1. Choose a crypto exchange

As mentioned above, we’ll be using eToro for this guide as they are a widely used exchange and have over 50 cryptocurrencies to choose from. They also have a few really neat features like “Copy Trading”, which enables users to copy the trades of popular investors on the platform.

You can, of course, use any trusted crypto exchange for this, the steps will be very similar for most exchanges.

Let’s get started!

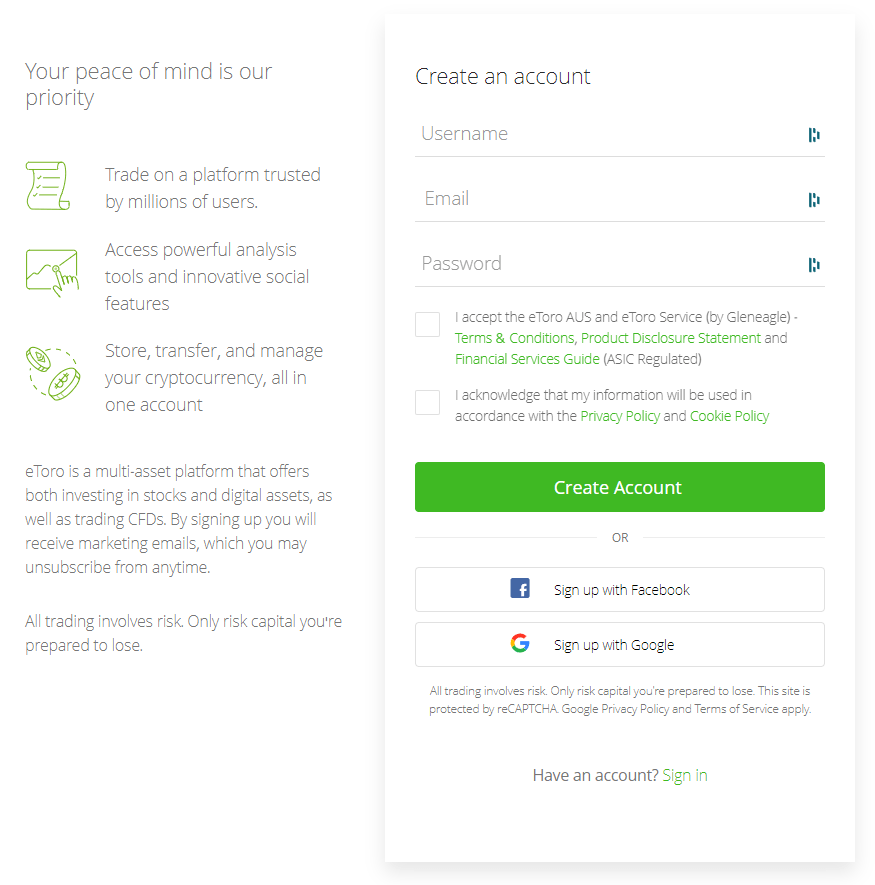

2. Sign up with the trading platform

The first thing to do is to sign up with the platform.

Once you’ve completed the initial sign up process, you’ll have to go through a quick verification process (also known as KYC).

3. Funding your account

Next up is funding your account. When it comes to depositing money to your eToro account, you have the option to use a bank transfer, PayPal, credit/debit card, and more.

4. Buy crypto

Finally, just go to the eToro Markets section, find the cryptocurrency you would like, and buy it.

And that’s it, it’s all pretty straightforward, now you know how to buy bitcoin or most other cryptocurrencies with St. George Bank.

About St. George Bank

St.George Bank, an Australian bank, has its headquarters in Sydney. The bank is now part of Westpac after a 2008 merger. It was previously an independent legal entity. St.George was deregistered in 2010 and no longer authorised as a deposit-taking institution.

Although the bank is primarily located in New South Wales it has a growing presence in a variety of industries and business segments in Queensland, Western Australia and Victoria. This was before the relaunch of Bank of Melbourne in July 2011, which was also a division of Westpac. St.George operates in South Australia, the Northern Territory and under its subsidiary BankSA. There are many ATMs and retail branches across Australia. Some back office operations are also available in Bangalore, India.

The merger or acquisition of several banks and building societies resulted in the current bank.

On 6 May 1937, the St.George Co-operative Building Society Ltd. in Hurstville, Sydney was established. George Cross was the first chairman. In June 1937, the Cronulla & District Co-operative Building Society were formed. In 1945, the two Co-operatives were merged. With the boom in post-war housing, the St.George and Cronulla Building Society grew rapidly with 38 branches by 1955. The society was transformed into a Permanent Building Society in 1955. This allowed its loans to be more generous and terms to be shorter. The first branch opened in Miranda in 1961. In August 1963, the second branch opened in Sydney. Through the 1960s, the network of branches grew. 41 agencies were also managed by the society.

St.George, a building society in St. George, was the first to "go online" with the installation of an IBM mainframe computer that could be connected to 30 terminals. The black light signature system was used to sign passbooks. This system was adopted by banks in the 1960s.

John Laws, a radio announcer, almost caused a panic at St George Building Society in 1979 when he said that "a large building society was going bust". St George paid every withdrawal and kept its doors open. Neville Wran (then premier of NSW) stood later outside a branch to say he could personally ensure the society's financial security.

The headquarters were moved to Montgomery Street in Kogarah in the 1990s. In 1992, the society obtained its banking license and was demutualized. It became a public corporation.

In 1939, the NSW Permanent Building & Investment Society (NSWPB&I) was founded. In 1985, the society was incorporated as Advance Bank.

The Savings Bank of South Australia was established in Adelaide in 1848. In rural South Australia, it became the State Bank of South Australia. Both banks were guaranteed by South Australia. In 1984, the two banks merged and were traded under the name of the State Bank of South Australia. The guarantee of the Government remained intact. The bank crashed due to insufficiently secured lending during the 1980s. The guarantee was used to bail out the State Government. The bank was divided into two parts in 1992: the "bad" bank with non-performing loans and the "good" bank.

The Advance Bank purchased the "good bank", which was kept operating under separate names by the Bank of South Australia. It trades as BankSA.

St.George Bank took over Advance Bank and its BankSA subsidiary in 1997.

St.George, like Advance Bank, has maintained BankSA as an independent entity. It has 55 branches in Adelaide metropolitan, 66 in rural South Australia (totalling 121) in total, four in the Northern Territory, and one in Queensland.

St.George Bank reported a net profit (A$1bn) for 2005/06 on November 1, 2006. This was a 17.9% increase over the previous year and a record profit. St.George Bank Limited, as it was known at the time, was Australia's fifth-largest bank.

St.George typically promotes itself as more friendly and customer-service-oriented than the "big four" banks operating nationally in Australia, although it is now a part of the Westpac Group. Although the bank was once recognized in third-party surveys as a leader in customer service, the 2010 CHOICE consumer poll showed that customer satisfaction was not the same as the "big four" and was behind small credit providers.

Although the bank was founded in 1924 as a home and consumer lender, it now provides financing to a wide range of market segments, including construction and development of commercial properties, invoice discounting and foreign exchange. St.George Finance Limited, St.George Motor Finance Limited and the Automotive Finance division are both subsidiaries of St.George Bank. They have been rebranded under the Bank of Melbourne in Victoria.

Related:

Author: Marco Vela -

Author: Marco Vela -