How to Buy Crypto with Royal Bank of Scotland

Summary: While Royal Bank of Scotland doesn’t offer crypto trading on its own platform, you can easily use your account to buy crypto using a third-party crypto trading platform.

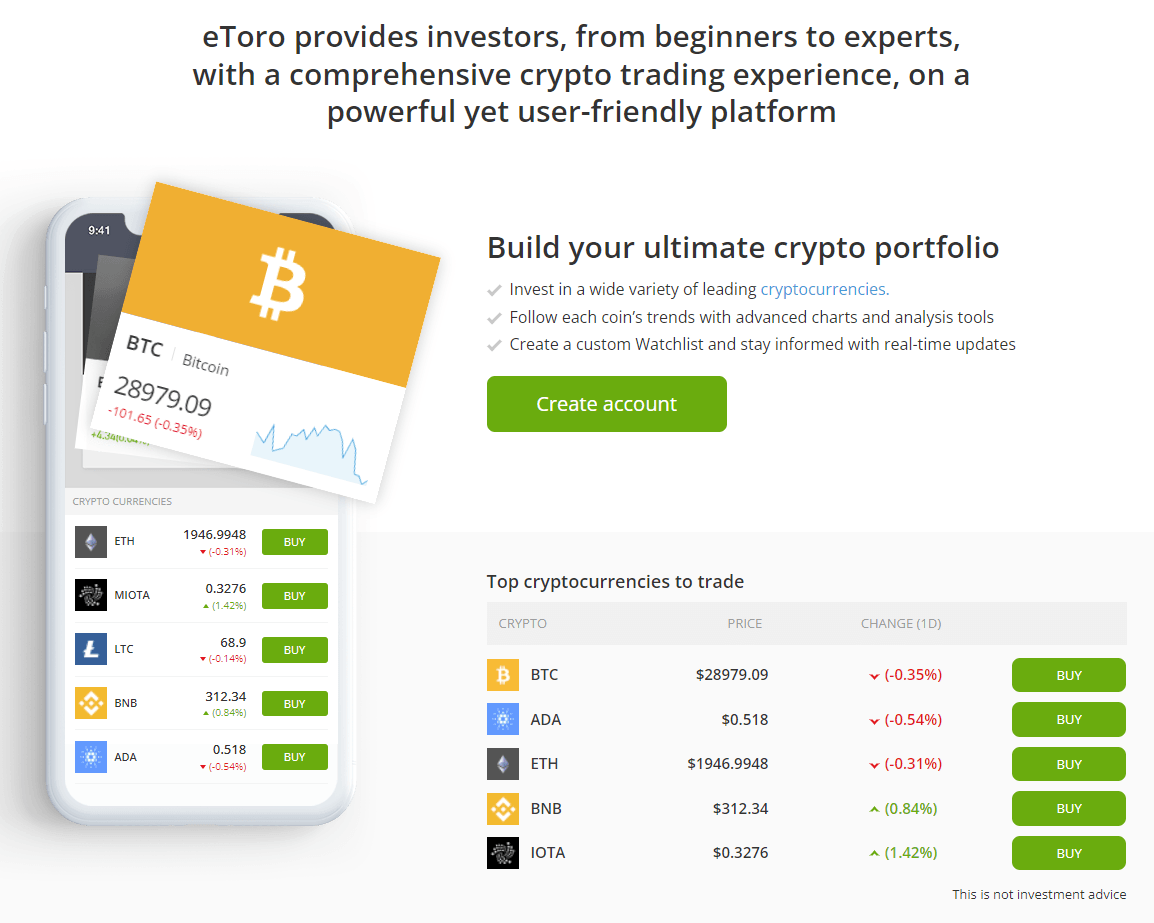

There are plenty of crypto exchanges to choose from, we recommend using eToro as the exchange to work with.

They have most of the popular cryptocurrencies available, are easy to work with, and have fantastic support!

Buy Crypto with eToro

[Rated 4.2/5 based on 15710 reviews on Trustpilot]

As mentioned above, just like most banks, Royal Bank of Scotland doesn’t offer cryptocurrency trading directly, as setting up a cryptocurrency trading platform is quite complex and comes with regulations and extra requirements for the banks.

There are many cryptocurrency trading platforms that you can use for buying bitcoin and other cryptocurrencies.

You can sign up for an exchange (we will use eToro as our example because it is a trusted and worldwide exchange) and transfer funds to the exchange to trade crypto.

Table of Contents

How to buy crypto or bitcoin with Royal Bank of Scotland

There are only 4 steps involved, let’s get started!

1. Choose a cryptocurrency exchange

As mentioned above, we’ll be using eToro for this guide as they are a widely used exchange and have over 50 cryptocurrencies to choose from. They also have a few really neat features like “Copy Trading”, which enables users to copy the trades of popular investors on the platform.

You can, of course, use any trusted crypto exchange for this, the steps will be very similar for most exchanges.

Let’s get started!

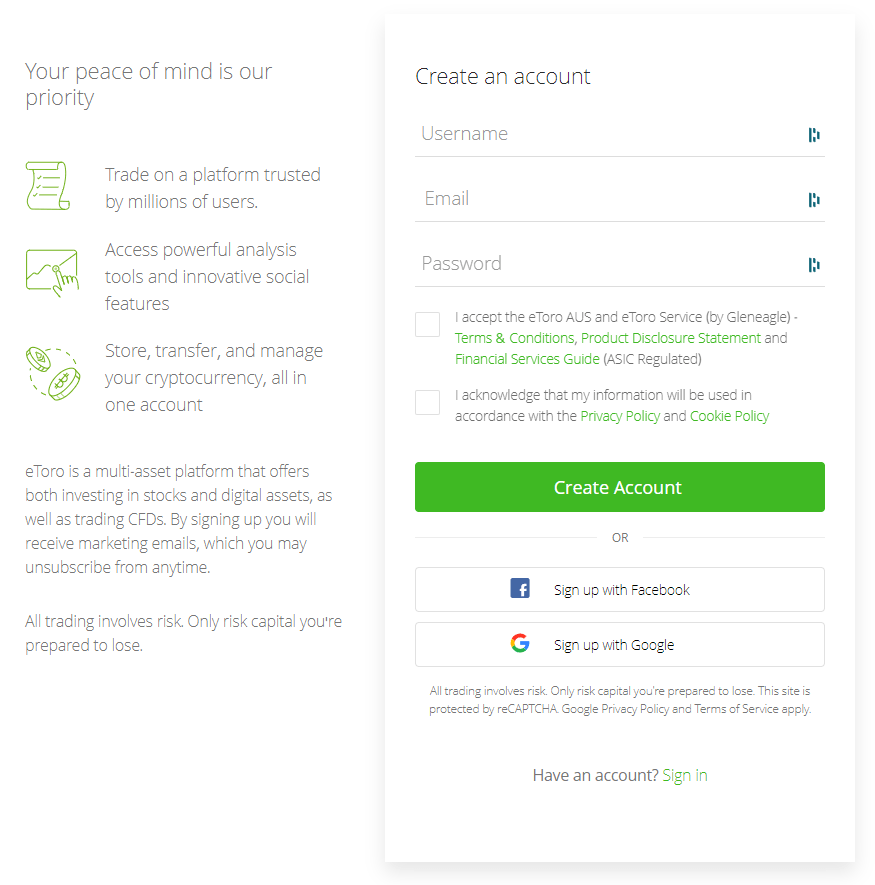

2. Sign up with the trading platform

The first thing to do is to sign up with the platform.

Once you’ve completed the initial sign up process, you’ll have to go through a quick verification process (also known as KYC).

3. Funding your account

Next up is funding your account. When it comes to depositing money to your eToro account, you have the option to use a bank transfer, PayPal, credit/debit card, and more.

4. Buy crypto

Finally, just go to the eToro Markets section, find the cryptocurrency you would like, and buy it.

And that’s it, it’s all pretty straightforward, now you know how to buy bitcoin or most other cryptocurrencies with Royal Bank of Scotland.

About Royal Bank of Scotland

The Royal Bank of Scotland plc, a major commercial and retail bank in Scotland, is the Royal Bank of Scotland plc. It is part of the NatWest Group's retail banking subsidiaries, along with NatWest (in England & Wales) and Ulster Bank. There are approximately 700 branches of the Royal Bank of Scotland. Most of these are located in Scotland. However, there are also branches in larger cities and towns throughout England and Wales. This bank is separate from the Bank of Scotland (located in Edinburgh) which was founded 32 years before the Royal Bank. To provide a bank with strong Hanoverian or Whig ties, the Royal Bank of Scotland was founded in 1724.

After ring fencing of the Group's core domestic businesses, the bank became a direct subsidiary in 2019 of NatWest Holdings. NatWest Markets is the Group's investment bank arm. The former RBS entity was renamed NatWest Markets to give it legal form. Adam and Company, which held a separate PRA bank licence, was renamed The Royal Bank of Scotland. Adam and Company will continue as an RBS private brand in Scotland along with the Messrs. Drummond and Child & Co. companies in England.

The Society of the Subscribed Equivalent Debt is the bank's origin. It was established by investors in the failing Company of Scotland to safeguard the compensation they received under the 1707 Acts of Union. In 1724, the Equivalent Society became the Equivalent Company. The new company wanted to enter banking. The British government accepted the request favorably because the "Old Bank", which was the Bank of Scotland, was suspected of having Jacobite sympathies. The "New Bank", also known as the Royal Bank of Scotland was chartered in 1727. Archibald Campbell, Lord Ilay was appointed its first governor.

The Royal Bank of Scotland invents the overdraft on 31 May 1728. This innovation was later recognized as a breakthrough in modern banking. It gave William Hogg (a merchant on the High Street of Edinburgh) access to PS1,000 (PS138.272 in today’s value).

The issue of banknotes was the focal point of fierce competition between the Old Bank and the New Banks. The Royal Bank's policy was to either take over the Bank of Scotland or drive it out of business on favorable terms.

The Royal Bank accumulated large amounts of Bank of Scotland's bank notes. These notes were acquired by the Royal Bank in exchange for its own notes. They were then presented to the Bank of Scotland immediately for payment. The Bank of Scotland had to call in its loans to pay these notes and was forced to suspend payments in March 1728. This suspension relieved immediate pressure on Bank of Scotland, but at great cost to its reputation. It also gave the Royal Bank the freedom to expand its business, even though the Royal Bank had a higher note issue that made it more vulnerable.

The Royal Bank was not able to merge with the Bank of Scotland despite rumors. The Bank of Scotland was able, in September 1728, to begin redeeming its notes with interest again. In March 1729, it resumed lending. The Bank of Scotland added an "option clause" to its notes. This gave it the power to make the notes interest bearing and defer payment for six months. The Royal Bank also followed this example. The two banks finally decided that their mutually destructive policy was unsustainable and made a truce. However, it took until 1751 for the banks to agree to each other's notes.

In 1783, the bank opened its first branch outside of Edinburgh. It also opened a branch in Glasgow in 1783. This was in part of a high street draper's shop. In the early part of the nineteenth-century, additional branches were opened in Dundee and Rothesay as well as in Dalkeith, Greenock (Port Glasgow), Leith, and Dalkeith.

The bank moved its head office from Edinburgh's Old Town in 1821 to Dundas House on St. Andrew Square, New Town. As seen from George Street, the building forms the eastern end the New Town central view. Sir William Chambers designed it as a Palladian mansion for Sir Lawrence Dundas. It was completed in 1774. John Dick Peddie designed an axial banking hall (Telling Room), behind the building. It features a blue domed roof and gold star-shaped coffers. Dundas House, the bank's registered head office, is still in use today as the banking hall.

The bank attempted to merge with other Scottish banks in the second half of the nineteenth century, primarily as a response for failing institutions. After the collapse of the Western Bank in 1857, the assets and liabilities were acquired by the Dundee Banking Company in 1864. The Royal Bank of Scotland had 158 branches by 1910 and approximately 900 employees.

In 1969, the economic environment was becoming more challenging for the banking industry. The Royal Bank of Scotland and National Commercial Bank of Scotland were merged to address this problem. The new holding company, National and Commercial Banking Group, was formed with 662 branches across Scotland. All of these branches were transferred to the Royal Bank. In 1979, the holding company was renamed The Royal Bank of Scotland Group and transformed into NatWest Group in July 2020.

In 1960, New York opened the first international bank office. In New York, the bank opened its first international office in 1960. Citizens Financial Group, a bank located in Rhode Island, United States, was acquired by the bank in 1988. Citizens has since acquired many other American banks, including Charter One Bank in 2004. Citizens Financial Group, an American bank, was owned by Citizens from 1988 to 2015. RBS Group, which was the second largest shareholder in Bank of China (the fifth-largest bank globally in terms of market capitalisation) was acquired in 2005.

Related:

Author: Marco Vela -

Author: Marco Vela -