How to Buy Crypto with CommBank

Summary: While CommBank doesn’t offer crypto trading on its own platform, you can easily use your account to buy crypto using a third-party crypto trading platform.

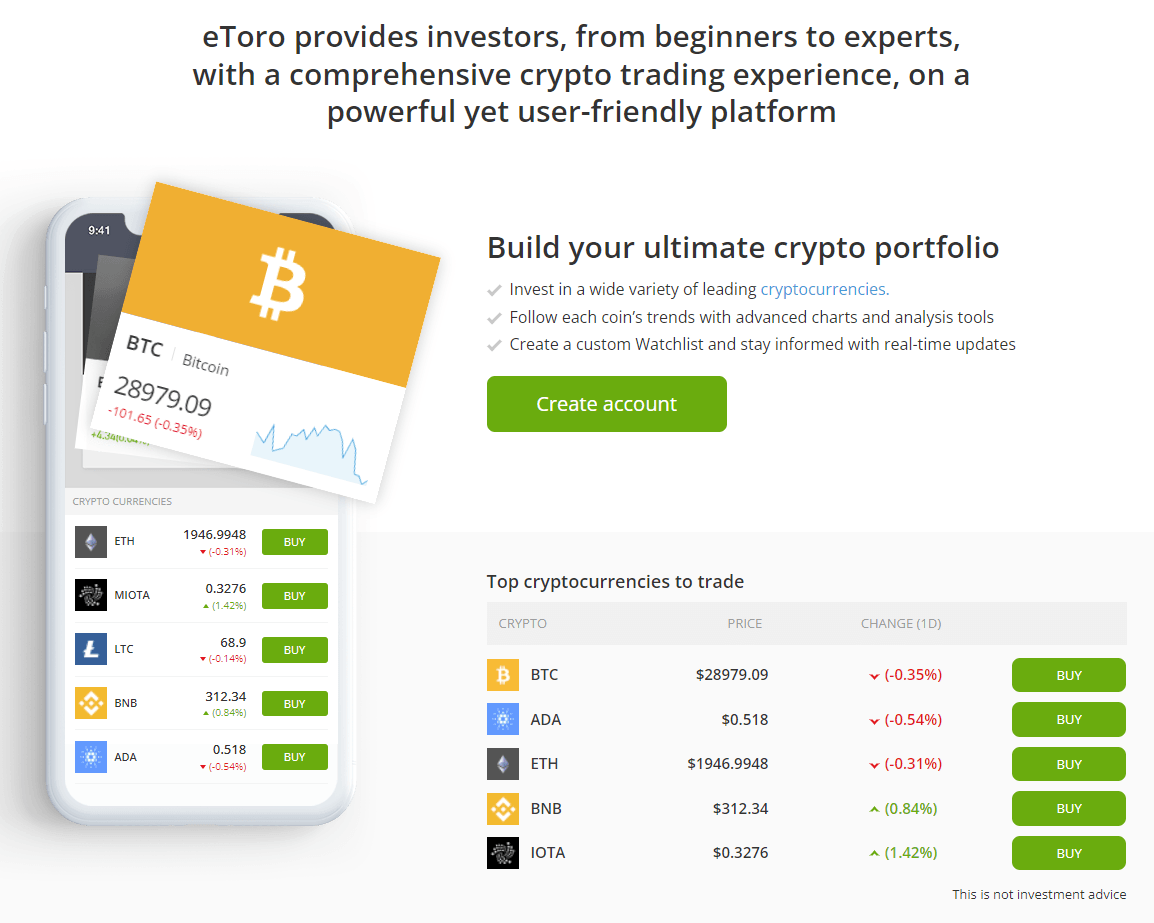

There are plenty of Australian crypto exchanges to choose from, we recommend using eToro as the exchange to work with.

They have most of the popular cryptocurrencies available, are easy to work with, and have fantastic support!

Buy Crypto with eToro

[Rated 4.2/5 based on 15710 reviews on Trustpilot]

As mentioned above, just like most Australian banks, CommBank doesn’t offer cryptocurrency trading directly, as setting up a cryptocurrency trading platform is quite complex and comes with regulations and extra requirements for the banks.

There are many crypto trading platforms that you can use for buying bitcoin and other cryptocurrencies.

You can sign up for an exchange (we will use eToro as our example because it is a trusted and worldwide exchange) and transfer funds to the exchange to trade crypto.

Table of Contents

How to buy crypto or bitcoin with CommBank

There are only 4 steps involved, let’s get started!

1. Choose a crypto exchange

As mentioned above, we’ll be using eToro for this guide as they are a widely used exchange and have over 50 cryptocurrencies to choose from. They also have a few really neat features like “Copy Trading”, which enables users to copy the trades of popular investors on the platform.

You can, of course, use any trusted crypto exchange for this, the steps will be very similar for most exchanges.

Let’s get started!

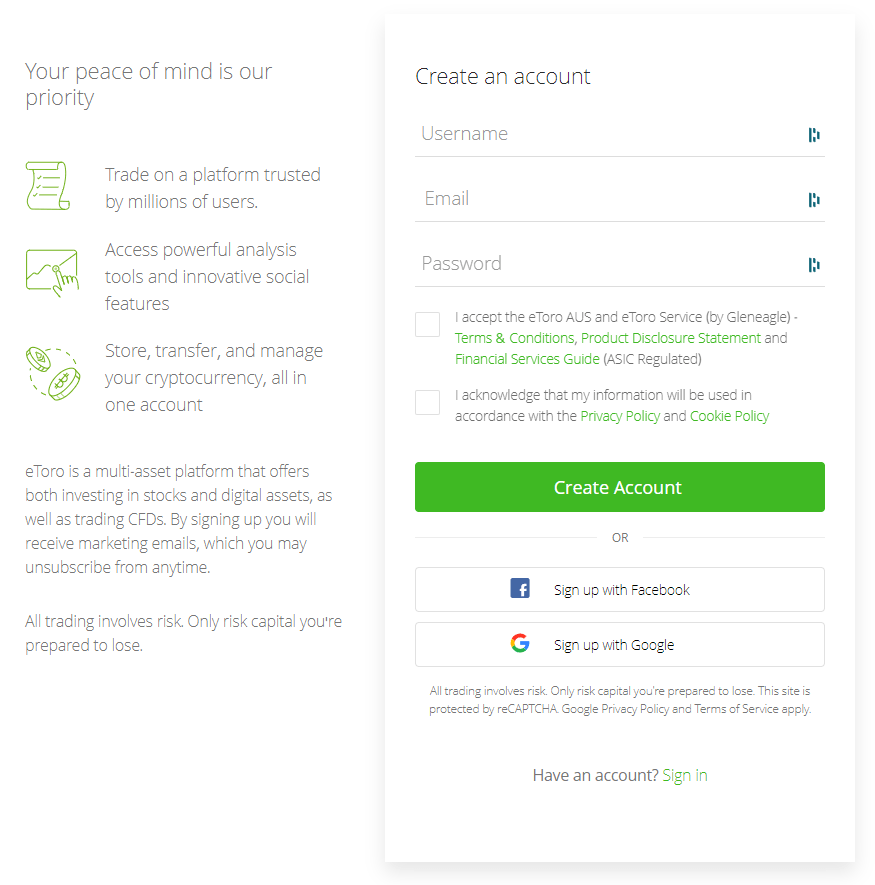

2. Sign up with the trading platform

The first thing to do is to sign up with the platform.

Once you’ve completed the initial sign up process, you’ll have to go through a quick verification process (also known as KYC).

3. Funding your account

Next up is funding your account. When it comes to depositing money to your eToro account, you have the option to use a bank transfer, PayPal, credit/debit card, and more.

4. Buy cryptocurrency

Finally, just go to the eToro Markets section, find the cryptocurrency you would like, and buy it.

And that’s it, it’s all pretty straightforward, now you know how to buy bitcoin or most other cryptocurrencies with CommBank.

About CommBank

The Commonwealth Bank of Australia (CBA), also known as CommBank, an Australian multinational bank, has branches in New Zealand, Asia and the United States. It offers a range of financial services, including superannuation, investments, broking, and retail banking. As of August 2015, the Commonwealth Bank was the largest Australian listed company on Australian Securities Exchange. It has brands such as Bankwest, Colonial First State Investments and ASB Bank (New Zealand), Commonwealth Securities, CommSec, and Commonwealth Insurance (CommInsure).

The Commonwealth Savings Bank of Australia and Commonwealth Trading Bank were its former parts.

The Commonwealth Bank was established in 1911 by the Australian Government. It was privatized in 1996 and is now one of the "big 4" Australian banks. In 1991, the bank was listed on Australia's Stock Exchange.

The Commonwealth Trading Bank Building at the corner of Pitt Street, Martin Place, Sydney was the former headquarters of Commonwealth Bank. It was renovated from 2012 for commercial and retail uses. From 1984 to 2012, the State Savings Bank Building was located on Martin Place. This building was then sold to Macquarie Bank in 2012. Tower 1, 201 Sussex Street, and two nine-storey new buildings were constructed on the site of the former Sega World Sydney. They are located in Darling Harbour, Sydney's western side.

The Royal Commission into Misconduct of the Banking, Superannuation and Financial Services Industry found that there was a negative culture in the Bank, with allegations of fraud, deception, and laundering money, among other crimes.

The Commonwealth Bank Act 1911 was passed by the Andrew Fisher Labor Government to establish the Commonwealth Bank of Australia. It took effect 22 December 1911. The bank had both general and savings business, which was a rare feat at the time. It was also the first Australian bank to receive a federal guarantee. King O'Malley (an American-Australian Labor politician) was the bank's first and most tireless advocate. Sir Denison Miller was its first Governor.

On 15 July 1912, the bank opened its first branch at Melbourne. The bank traded through post offices agencies as part of an agreement it made with Australia Post. It took over the State Savings Bank of Tasmania in 1912 and had branches across all six states by 1913.

The bank moved its headquarters to Sydney in 1916. It was also a follower of the Australian army to New Guinea, where it established a branch at Rabaul and other agencies.

Related:

Author: Marco Vela -

Author: Marco Vela -